The Tax Cuts and Jobs Act (TCJA) was signed into law by President Donald Trump on December 22, 2017. The TCJA has brought with it many sweeping changes to a broad part of the tax code. Some of the notable changes include:

(1) Elimination of personal exemptions – previously taxpayers were allowed to subtract $4,500 from their income as a personal exemption.

(2) Elimination of the “personal mandate” enforced by the Affordable Care Act (known more commonly by many as “Obamacare”) – it is important to note that the elimination of this penalty did not go into effect until January 1, 2019. Hence, if you failed to obtain “qualifying health coverage” in 2018, the IRS will assess the penalty.

(3) Expansion of the Child Tax Credit – the TCJA increased the Child Tax Credit from $1,000 to $2,000. The income level at which point the tax credit phases out has been raised from $110,000 to $400,000 for married tax filers. The age cut-off stays at 17 (child must be under 17 at the end of the year for taxpayers to claim the credit). The refundable portion (applicable to parents who do not earn enough income to pay taxes) of the credit is limited to $1,400. This amount will be adjusted for inflation after the 2018 tax year.

(4) Standard deduction for single filers increased by $5,500 and by $11,000 for married couples filing jointly (see Table 2 below). Most itemized deductions eliminated.

(5) Mortgage Interest Deduction Reduced (learn more).

(6) If you’re caring for an elderly parent, you can get a $500 credit for each non-child dependent.

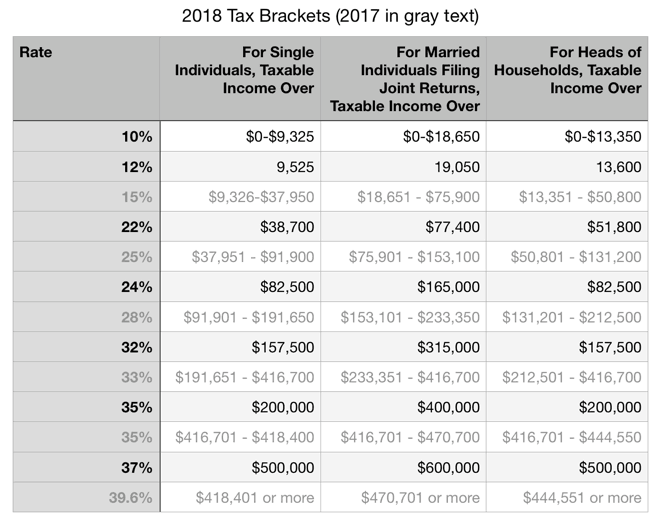

(7) Tax table changes (see Table 1 below)

To protect individuals that are pushed into higher income tax brackets due to reduced value from credits and deductions instead of increase in real income (known as “bracket creep”), the act also requires that the IRS adjust numerous tax provisions for inflation.

2018 Income Tax Brackets and Standard Deduction Rates

Table 1. 2018 Income Tax Brackets and Rates

Table 2. 2018 Personal Exemption and Standard Deduction

The personal exemption for 2018 is eliminated

their stock as an ordinary loss, which is likely to be a significant impact difference on a shareholder’s personal return from stock being treated as a capital asset and hence losses being deducted as capital losses, provided the qualifications and limits found below are met. If you own stock in a small “domestic corporation” (note: as LLCs are state created entities that are taxed differently than corporations the membership interest in the LLC cannot be treated as section 1244 stock as defined in Title 26) and you plan to dispose of it for a given tax year, certain qualification requirements must be met.

their stock as an ordinary loss, which is likely to be a significant impact difference on a shareholder’s personal return from stock being treated as a capital asset and hence losses being deducted as capital losses, provided the qualifications and limits found below are met. If you own stock in a small “domestic corporation” (note: as LLCs are state created entities that are taxed differently than corporations the membership interest in the LLC cannot be treated as section 1244 stock as defined in Title 26) and you plan to dispose of it for a given tax year, certain qualification requirements must be met.